How to Make a Fortune By Owing A Nursing Home Property

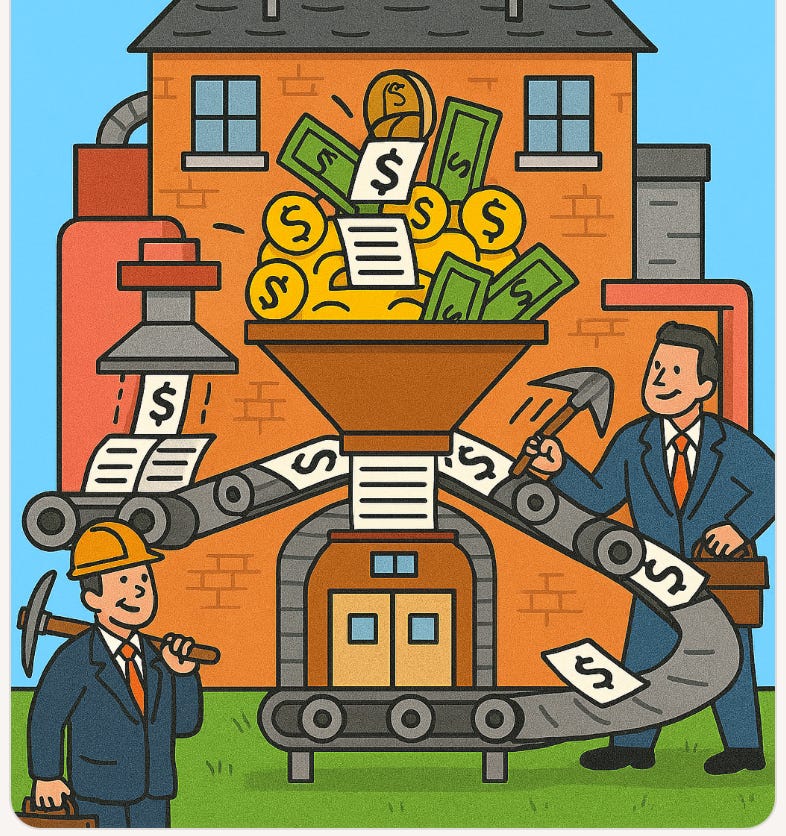

Most Americans are not aware that owning nursing homes provides a nearly fool-proof opportunity to make a fortune. I am herewith providing a detailed plan for how you can become a wealthy owner.

The barrier to entry is surprisingly low. It does not require any skills that are challenging to develop. There is no special educational requirement to get into the business. Nor prior experience. Since licenses and regulations are managed by the state government, all the information one needs to learn what is required by the state it is located in. CMS (Center for Medicare and Medicaid Services) provides guidelines and recommendations for operational procedures, and also provides rating scales for operational quality. But they have virtually no enforcement powers.

Certification of this business category is provided at the state level. Some states are easier than others, but acquiring it is easier than many business sectors. That includes states that think they have high standards.

There are very few toothy laws and regulations that govern nursing home businesses. And even more enticing, the enforcement of them is so lax it is possible to get away with a lot of subpar practices. This can greatly enhance profitability. As I list and describe what a nursing home operator can legally get by with, you will be shocked at what a great business opportunity this is, as long as your moral compass is highly flexible. If that is the case, you will be searching real estate sites for properties as soon as you finish reading this article!

Before I provide business planning details, I will address why this opportunity is so wide open and why it is likely to remain so far into the foreseeable future.

A. The population that occupies these facilities have no voice or political clout. They have little to no money, so they cannot invest in politicians to protect them. These occupants are more accurately classified as inventory or billable units, than as patients or humans in need.

B. There is little, if any, upside for politicians to advocate for occupants. There is no downside to ignoring them. Politicians get political donations from nursing home owners and operators, but never from residents. This calculation explains why there are no calls for close scrutiny or penalization for low quality operators.

C. The general public is tone deaf to the reputation and manner of operating facilities, which number nearly 15000 nationwide. That is...until they have a family member who has reached a stage in life that requires skilled nursing facility care. Even then, they often do not realize they will likely be blindsided regardless of where they may place their family member because they do not have the knowledge needed to evaluate quality of care. This is an industry that does not attract mainstream attention, generally speaking.

D. There are organizations that pose as advocates for families seeking help with selecting a good facility for there elder in need. The reality is many are paid generous commissions for placing that resident in their location. Locations with low ratings use these placement services. Locations with high ratings do not need them and often have a waiting list. There are no restrictions to how fee for placement service companies operate.

E. The population that will need these facilities for end of life placement is growing rapidly. It is predicted that by 2050 the over 80 years of age population might be over 30 million people. When we divide that 30 million by 15,000, which represents a rounded up number of eldercare locations, that calculates to a potential resident population of over 2000. The current national average size of a facility is just over 100 beds. Those are very loosely calculated projections, but we can see the future market is very robust.

F. To maintain an operating license, owners agree to an inspection regimen. CMS recommends at least one unannounced site inspection every two years. Not to worry! It is common for a property to learn in advance when a state inspector will pop in. These inspections seem to lack a consistent quality, not just state by state, but from one inspection to the next. It is also common for many properties to not be inspected within the two year time frame. But what is most interesting is that when a property inspection reveals substandard operating practices, there is not any punitive actions that disrupt the profitability of the company. The meager fines occasionally assessed is considered to just be another cost of doing business.

G. Financial reporting is supposed to be audited with some regularity by state officials to verify accuracy and compliance with regulations. Much of the time, this does not happen. Nursing home businesses do not need to worry about there financial reports being closely scrutinized. This results in very incomplete and even misleading representations of financial condition and practices. That is really beneficial to owners, and is detailed more clearly in the next item.

H. The financial reports submitted to CMS and the state that grants an operating license are supposed to align with GAAP and provide a transparent representation of the fiscal condition of the property. In reality, it is common for the reports provided to CMS to be very obscure, even to the point of incorrectly classifying many expenditures and income sources. Generally, there is no need to fear getting caught when choosing to submit faulty reports.

I. State nursing home regulations require the appointment of ombudsmen to represent and advocate for occupants when complaints are filed. Research into the efficacy of this arrangement reveals that a nursing home owner does not need to worry about negative consequences and outcomes when an ombudsman follows up on, or investigates, a complaint. What ever the incident reported by the complainant might be, it happened in the past and there rarely is any trailing evidence to confirm bad conduct and misbehavior by staff or management. This results in the ombudsman’s report rarely recommending any follow up or punitive action.

As we can see, the “stacked deck” for nursing home operator oversight greatly favors the ownership far more than the occupant. Therefore, by adapting the following operations procedures, there is much profit to be made! And the good news is that the procedures are not complicated.

So...let’s go into business!

There does seem to be a gold rush atmosphere in the nursing home acquisition market in 2025. A new record for ownership change was just benchmarked in November, topping 720 locations. If anyone needs confirmation that the market believes this business sector has great profit potential, that indicator should help.

Step 1 - Of course, the first step is to find and purchase a property. The business models and activities of properties vary greatly. The following groupings are examples of the variety.

a. There are some that specialize in rehabilitation, so they tend to be somewhat of a revolving door. A typical stay is in the range of 90 days. This time span is governed by what medical insurance companies are contractually bound to pay for. If a patient needs longer care than that, they do not continue to be classified for rehab.

b. Another category is memory care. These facilities have very different operating requirements, with specialized training for staff. Operating costs tend to be higher, but so are reimbursement rates. The patients can be a bit unruly, but that can also be somewhat neglected without getting caught or penalized.

c. There are CCRC properties. Those letters stand for continuing care retirement community. These are larger scale properties because they commonly provide private housing that enables residents total freedom to come and go on their own, much like an apartment or condo. The next level of care is assisted living, which includes limited nursing services as needed depending on the condition of the resident, but the environment is still somewhat independent. The final level of care, literally and figuratively, is the skilled nursing unit, which includes the resident becoming a patient whose living quarters are essentially like a hospital room. CCRC properties can be very profitable due to the spend down practice and the ability to charge exorbitant rates. I will detail more about that later.

d. Many properties are only the SNF category where constant care and monitoring of the patient is necessary and the staffing is weighted toward registered nurses (RN) and certified nursing assistants (CNA). These properties have high profit potential because operators can get by with understaffing and ignoring patients because they tend to not be very capable of making demands about their care.

Note: Some states are more stringent than others where attention and regulation are concerned. Do your homework about that before you make a final acquisition decision.

That represents the primary category groups for the senior warehousing, or rather, care facilities. As a future owner, decide which type of facility you want to own, and reach out to realty businesses that specialize in this market.

Step 2 - Now you own a facility. At this step, you will want to set up your legal business structure. Do not even consider any option other than a Limited Liability Corporation (LLC). The range of questionable operating options for LLCs is unlimited, if you will pardon the pun. Do not stop with just one LLC. Following is a list of options.

a. The first LLC should be the overarching operating company that includes all owners.

b. The second LLC can be the legal property owner that is registered with the county assessor’s office for property tax and valuation purposes.

c. The third LLC can be the leasing company that sets and collects the rent amount the property pays. You may want to consider another LLC that owns the land that the property occupies. That is another source of rental income in addition to the building.

d. Next, form an LLCs for the staffing service you will provide to the property so you can charge large fees to the property by using contractors instead of employees.

e. Another source of extraction, or make that revenue, can come from an LLC for dietary services so you can over charge for very low-quality meals for the occupants.

f. An LLC for laundry services is another opportunity to extract more cash from the business.

g. Use your imagination! Make a list of every expenditure that is routinely made to maintain operations. Each item is a potential LLC in and of itself that can be added to your portfolio of legal related parties.

All but the first and highest-level LLCs are classified as “related parties”. Believe it or not, all this is totally legal, and there is currently no cap on the amount that can be charged. It is not wise to be too aggressive with this operating process because you do not want to constantly show big operating losses. That may attract a closer look by regulators.

You are advised to program your cash extractions at a level that makes the property appear to be just barely getting by. This positions you to loudly complain to your state government about the need for larger Medicaid and Medicare reimbursements, since that is the primary source of revenue for your business. Because the state government and regulating agencies are so disorganized and distracted, there is generally no need to be concerned about close examination.

Other revenue gold to be mined –

You can line your pockets with another amazing source that has no limits or regulations. I mentioned it above. It is called the spend down allowance. You will have a hard time believing this is legal, but it is true and real.

When an occupant is placed in your facility, it is common for them to have personal assets of considerable value. For example, they may have a residential property with a paid-off mortgage. They may have a substantial retirement nest egg. There are many asset classes that they might possess, and you can steal (I didn’t mean to say that..), or acquire all of that until it is completely in your possession.

You are legally allowed to base your monthly rate on the occupant at any amount you choose. It can be several times the Medicaid reimbursement rate. Medicaid requires the occupant to be classified as being in poverty. Taking everything they spent their entire life earning and accumulating makes them poor. I realize all of this is hard to believe, but it explains in part why the property acquisition market for this business category is so robust.

Why isn’t the spend down policy regulated to align with the Medicaid reimbursement rates in order to cap what the occupant has to pay, and also save the government billions of dollars, you ask? It is not wise or profitable to ask questions like that out loud.

Congratulation! You are now set up to make a lot of profit while posing as operating on the brink of financial ruin. Is this a great country, or what?

There is no other business sector in America that can legally operate like this. That explains why there is a quiet rush by private equity and REIT organizations to move money into senior care facilities. It is hard to top the advantage of housing a constituency that has no voice or political power, combined with guaranteed government revenue as your income stream.

You are welcome!

Kent Comfort is the executive director of CHIP (Center for Health Information and Policy), which is a non-profit educational organization that captures and analyzes financial and operational data related to all aspects of the senior care industry.